Tips for Sniffing Out if a Company You Do Business With Might Be Headed for Bankruptcy

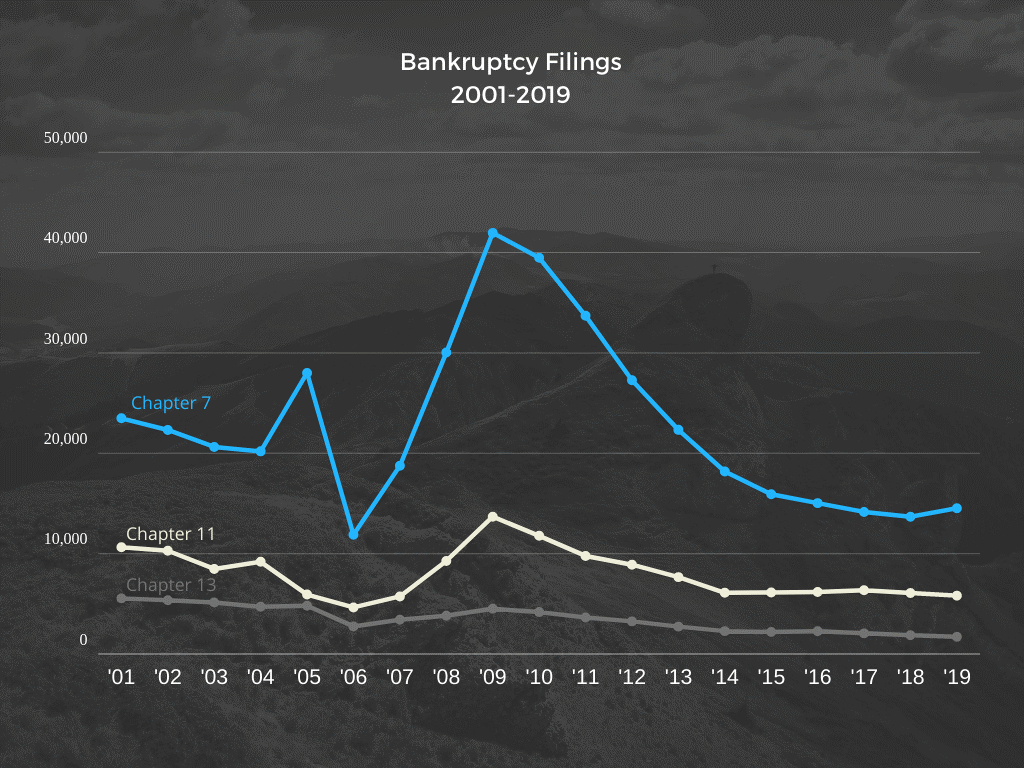

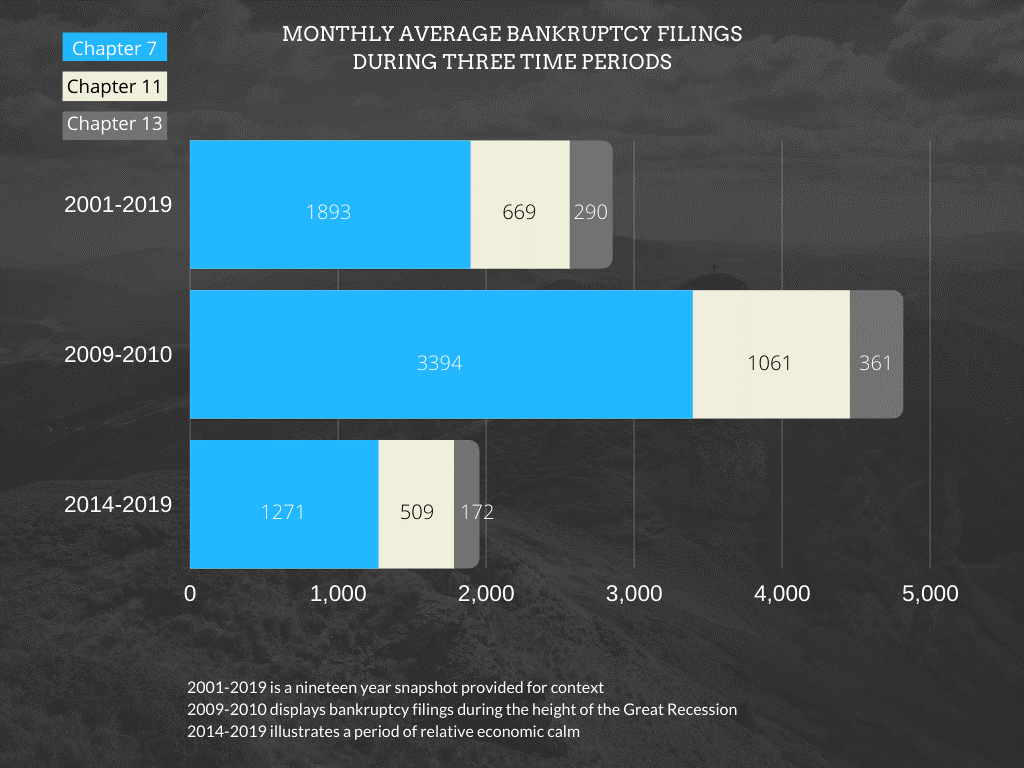

With the current economic challenges, U.S. businesses may face a pending wave of bankruptcies that will exceed what we experienced during the Great Recession of 10 years ago. Corporate debt has increased dramatically over the past several years. There have been warning signs—even before the current COVID-19 crisis—that many businesses were on shaky financial ground. Additionally, according to the American Bankruptcy Institute (ABI), Chapter 11 filings increased 26 percent in April over the prior year and a whopping 48 percent in May.

Clearly, Chapter 11 filings are on an upward trajectory. As I write this article, Chesapeake Energy has declared Chapter 11 and owes creditors at least $9B. Chesapeake is a large, publicly-traded company, but privately-owned enterprises are also at risk. To help make sense of the current landscape, I’ll briefly review three types of bankruptcy filings and then provide some context regarding what to watch to help safeguard your organization.

The Basics of Common Bankruptcy Types: 7, 11 and 13

Chapter 7 Bankruptcy

Chapter 7 bankruptcy is the most common type of filing. Individuals may use Chapter 7, but it is also available to partnerships or corporations with assets that may be used to cover debts. One benefit of Chapter 7 filing is that all collection actions typically must come to a stop.

Chapter 11 Bankruptcy

Chapter 11 bankruptcy involves crafting a reorganization plan to handle a company’s debt. It is available to businesses of all sizes. While filing Chapter 11 can be a complicated process, it allows a business to remain active and pay creditors over a defined period of time.

Chapter 13 Bankruptcy

Chapter 13 bankruptcy is primarily used by individuals to eliminate debt and pay back some or all of what is owed to creditors. Sole proprietorships are also eligible. Filing Chapter 13 bankruptcy involves the appointment of a trustee, which seldom occurs under Chapter 11 filings.

Bankruptcy Warning Signs to Watch For

Bankruptcies should be a cause for concern for all businesses because they could occur among your clients/customers, vendors, and businesses within your supply chain. Although there are some general early warning indicators that you can use to gauge the viability of the companies you work with, there is no predictive silver bullet that is full proof.

The Z-Score

The Altman Z-Score has been around for quite a long time. It was created in the 1960s by finance professor Edward Altman to determine the probability that a firm will enter bankruptcy. It was initially designed for manufacturing firms with assets exceeding $1M but has since been expanded to include other types of organizations. The Z-Score uses a combination of several different business ratios, such as working capital/total assets and retained earnings/total assets to arrive at a predictive score.

Here are three resources to help you better understand the Z-Score:

- The Altman Z-Score

- Altman Z Score as Bankruptcy and Quality Check

- Predicting Financial Distress of Companies: Revisiting the Z-Score & Zeta Models

You might also benefit from learning about some of the other bankruptcy prediction models out there.

Common-sense Bankruptcy Indicators

If predictive models regarding bankruptcy aren’t your jam or are simply not feasible for your situation, there are a few common-sense metrics to watch. My suggestions for using this approach include:

1) Educate your team about what to watch.

2) Determine when to dig deeper and collect more information about an organization.

Keep in mind, your risk extends both to vendors as well as key customers.

Here are a few early warning indicators to watch:

- Changes in executives/key management – Are mid- to high-level employees bailing out of an organization for no discernible reason? That might represent a company culture issue, or it might be an indicator that they know something important about the business’s financial viability.

- Asset sales – Is the business selling equipment, real estate, or other tangible assets? It might merely be streamlining or realigning operations, or it might be putting assets up for sale because it needs quick cash.

- Employee benefits – Are you hearing rumors about increased employee benefits contributions or cuts in benefits altogether? This is a go-to line item that many organizations chop when money is tight.

- Renegotiation of debt covenants – Are you hearing whispers from bankers? If you are, pay attention.

- Loss of key customers – Have you heard that a business’s key customers are switching to another provider? If so, ask why. The canary may be tweeting that the coal mine is in peril.

- Extended payment terms – Is a customer asking to push payment out to a later date, or is a vendor asking to be paid more quickly? This could simply be smoke, or there might be an actual fire. It’s time to put on your Smoky the Bear hat and dig a little deeper.

This list of “common-sense” indicators is far from complete, but it’s a place to start. You’ll find more helpful tips in the article, The Warning Signs of Bankruptcy: What Creditors Should be Watching For.

Think About the Unthinkable: Your Business May Depend on It!

Bankruptcy filings aren’t something that most businesses care to think about. Yet, in this time of uncertainty, it’s critical to pay attention to your environment and the companies that you deal with. Early indicators appear to be pointing toward a potentially massive spike in bankruptcy filings. You do not want to be caught unprepared if a key customer or vendor is already on life support.

With that thought, I’ll leave you with one final question.

Is the U.S. bankruptcy court system adequately staffed to handle a large surge in filings?

If the answer is “no,” reorganization plans may languish, and companies may instead be forced into liquidation—which might mean pennies on the dollar for you if you are their creditor. So, pay attention to this topic. You’ll want to keep as much control as possible over the reins because it’s likely we’re only at the beginning of this rodeo.

Want to discuss more strategies for navigating the challenges of the current business environment, let’s talk!