Understanding Accounting Roles and Functions

As organizations scale, several categories of inevitable questions often arise. Among them is the great big bucket of “Accounting” as leadership determines the type of accounting support their company will need.

Asking the right questions, like in the game show Jeopardy, is what wins the round. One of the most common questions I hear from leaders is a version of “When do I need to hire a CFO?” Unfortunately, this isn’t the exact question we should be asking. So, I “phoned a friend” to help me better understand the correct question to address. Thankfully, Nelson Tepfer, co-founder and managing partner of ProCFO, answered the call. Nelson’s organization provides fractional CFO services. I encourage you to visit their website to learn more about how they help businesses.

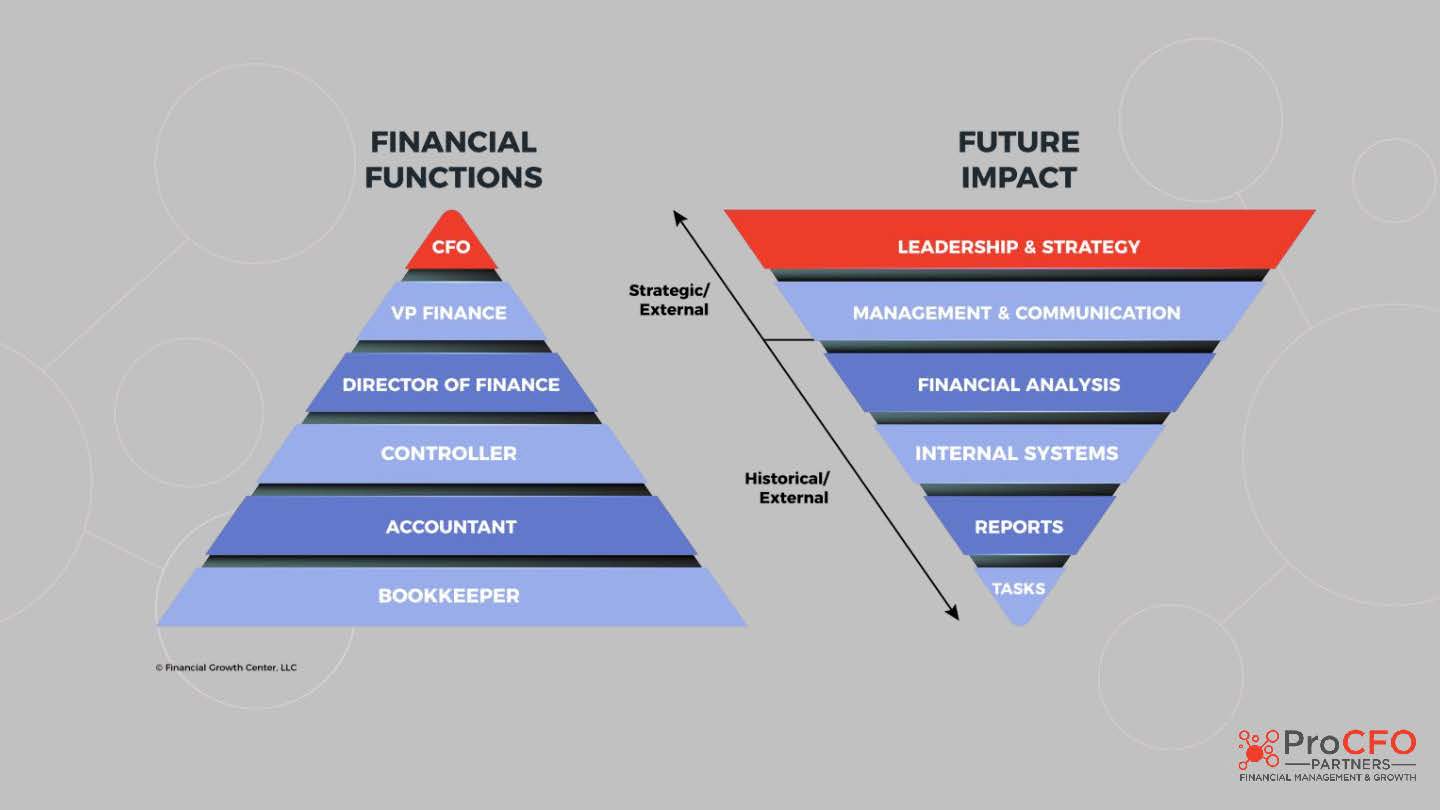

Nelson demystified a great many misconceptions about accounting roles and functions. Watch our discussion or scroll down for the transcript of our conversation. Also, check out the pyramids that ProCFO uses to explain the impact of financial functions and the CFO role.

If you have questions or want to dig deeper into this topic, get in touch with me or Nelson. I’m confident our discussion will help bring clarity to your planning and get you to the “final answer.”

TRANSCRIPT

Chad Harvey (00:05): Hey everybody. Chad Harvey here with Nelson Tepfer. Nelson’s the co-founder and managing partner of ProCFO. They provide part-time CFO services. And today I’ve got my military-style combat sweater on. We’re going to do combat with accounting terminology and we’re going to demystify some things and unpack some questions that I’m getting old lot of inquiries about from folks in terms of accounting roles and titles and what it all means. So Nelson, why don’t we start off just tell me just a little bit about ProCFO and who you are for our audience.

Nelson Tepfer (00:38): Sure. Thanks, Chad. Great to have this conversation with you. It’s a fun topic for us and one we get asked about probably just as much, if not more, than you. So we always enjoy chatting about it. For reference I guess, I am the co-founder and managing partner of ProCFO Partners, where I lead a team now of around 35 CFOs providing part-time CFO services for companies that don’t need, don’t want or cannot afford a full-time CFO. What we focus on though, and that’s what provides some context for this conversation, it’s about building the finance and accounting function in a way so it is systematic, sustainable, and scalable within the organization, built in a way so it supports the growth and goals of the company.

Chad Harvey (01:14): Wow. You’ve said that once or twice before, haven’t you?

Nelson Tepfer (01:14): Just a few. Yes.

Chad Harvey (01:17): Just a few. Okay. All right. Well, let’s dig right into it here. When you and I talked beforehand, I said to you, I’m getting just a ton of questions as people grow their businesses and get to certain sizes. What do all the positions mean? People want a nicely organized chart where they can just say, oh, I go from an accountant or I go from a bookkeeper to a this, to a that, to a CFO. And then people say, oh, well, what’s a controller? And I heard this comptroller term. And then there’s accounting clerks. And where are we at here? So let’s start at the foundational level here. What is needed? What do you see out there?

Nelson Tepfer (01:55): So for starters and I think, and this is something where many companies do get tripped up and that this is usually not the forte of the business owner who’s making these decisions. They’re usually not coming from accounting or fine backgrounds, nor should they be. I mean, they built their business because they’re experts at delivering this product or service that they built the company around. And that when it comes to these kinds of things, it’s like, well, someone told me I need to hire this person to do this. And great, they hire that person to do this. And then whatever number of years later that worked or that didn’t work and then they go back to their group and okay, now I need to hire this person to do this. So for most of this conversation, we’ll back away from titles for a moment and think about what is the function of the role that you’re looking at first, because we definitely find, especially in growing companies, the titles sort of become interchangeable and often confusing and misleading, depending on where the company’s up or what they’re trying to do.

So at the foundational level, which is where you ask the question, we’ll think of it very much task-oriented kind of role on the accounting side. This is where information gets entered for the most part within companies with whatever program or system that they’re using, QuickBooks, Xero or any of the other myriad of other ERP platforms and manufacturing programs that exist out there. We can run down the list if anyone is really curious. But from our perspective, it becomes about how does information get entered? How do we build clients? How do we track this information in there? This is where some confusion starts or complication can start again for that growing company, whether it’s cash or accrual, whether how we enter information, because that requires, if you’re moving onto accrual, which we believe most companies should for greater insight into what they’re doing, then it becomes what does a monthly close look like to give you that accrual information on a regular basis?

And the reason why we talk about that, even at this basic level, is understanding that all of this accounting stuff, whether it’s called the language of business or all kinds of other ways of referring to it that make it sound much cooler than it actually is, it’s all about giving you the insight you need to make the decisions you need to. So when we think of the foundational level within the organization, it’s how does information get entered your system? What does that person who’s doing it, what does their interaction level look like? What does that task list look like for that person or function?

Chad Harvey (04:09): And on the most excellent graphic that I’m popping up right now for our viewers, you simply list that as the bookkeeper function at the bottom of the pyramid, correct?

Nelson Tepfer (04:18): That’s correct. Now, what is important to recognize as you reference that graph, not every organization needs all six of those functional levels that we list out there. We will list out some of the generic ones or common ones that we come across, but for many growing companies, it may just be two functions on that entire graph. And that’s all that they need. What is important to recognize is that however many people or however many functional levels you have in that finance and accounting function, you still need every single one of those impacts. Who’s doing it, how it’s getting done and it will vary by the organization. But whatever that structure looks like on the functional side, you still need to make sure it is providing every single one of those impacts on the other side.

Chad Harvey (04:57): That is solid advice. And then as we move up that pyramid kind of go through the different levels, how do you help organizations assess when the handoff needs to occur or when they need to essentially escalate their talent in the accounting sectors?

Nelson Tepfer (05:14): So we look at it usually from that strategic side of a top down as thinking about this, again, from the higher level of 30,000 [inaudible 00:05:22] sometimes. What is this function supposed to be doing for you as a whole? What is this whole finance and accounting mystery box for some people, what is this whole thing supposed to be doing for you? Because understanding that what it’s supposed to be providing, whether it’s the reporting, whether it’s the analysis, whether it’s the strategic side of the conversation that may exist on this side, understanding what this function as a whole is supposed to be doing for you will allow you to say, okay, now once we understand this function, now it’s okay. What’s the ladder? What are the rungs here that we need to climb up in order to get where we’re trying to.

So for instance, we started with the bookkeeping or what I think more of the task-oriented kind of function. In our pyramid, we listed accountant next, because that’s usually what many companies may require when they start shifting into more of a real rigid accounting function or more rigid close on those kind of things. But for some companies, this was one function and that’s totally fine.

The next layer that we start thinking of about is when we start thinking of managing the task employees or managing that task function. What does that next level look like in managing that task? You can call that a controller. You can call it a director of finance. You can call it accounting manager. Again, the titles, and that’s why I hesitate to assign a title to it for many companies, because you ask 10 different people who have controllers, what their controller does, you will get 10 different answers. It’s one of those kind of roles that become a catchall for some people. And that’s not a bad thing. We understand why it happens.

Again, most business owners, most people who are doing this hiring, they’re not coming from this background to say, no, you are a controller therefore you should be doing X, Y, Z specifically. We look at it as, okay, we have the understanding, the task function that’s being delivered here with regards to how information gets entered, whether it’s RAP, RAR within the organization or just general all information gets gathered here in our QuickBooks file.

The next level that starts coming is managerial level. What are they looking at on a regular basis? So obviously it’s making sure the task level people are doing their job on a regular basis. That’s obviously a really important part of it. But then it’s become, what do we do that information once we actually have it? And that’s where we start getting into creating this function into a slightly more strategic one around now that we have information, how do we make that into insight? How do we make that into something we can actually take action on? Now, the reason why I say this starts happening at this level is, again, with many organizations, they only of this level at the functional level at the top. It only goes up to this level. So if that’s the case, then you need to make sure that’s being delivered even at this level of how do we start making the information into the analysis, into the insight that we can actually start making the decisions that we’re trying to make on an ongoing basis.

So it’s whatever we should be measuring. And for various reasons, yes, there’s financial statement reporting, which for many companies is a big enough hurdle by itself to make sure it’s both timely and accurate. But beyond that, think about it as the what KPIs, the key performance indicators, are they measuring and why. Within each organization, sometimes that looks very, very different depending on what they’re trying to achieve as a company as a whole, what they should be measuring and why. But that’s where it starts coming into place, once you start looking at that managerial level. So again, that may be a controller in some companies. That may be an accounting manager in other companies. So it’s really getting really clear on not the title you’re looking for, but what does that functional level start to look like within the organization?

Chad Harvey (08:36): So what’s coming through for me here, Nelson, is it’s very clear to me that have been called into organizations multiple times because people have hung a title on an individual and there is a complete mismatch either between the capabilities of the individual, the expectations of the ownership or the management. They haven’t defined the role properly. I can hear a lot kind of bleeding through the edges of your conversation with me.

Nelson Tepfer (08:59): Absolutely. And a lot of it just comes down to very often with where we started. There’s a lack of understanding what this actually looks like. They know what that they had isn’t good enough, but it becomes, okay, what should it be? And they don’t know what it should be. And again, for many organizations, a growing one, especially founder-led organizations, there’s no reason why they should know what is. It’s not like they teach this in school as to what your accounting function should look like. Even if they have whatever advanced degrees, many of the business owners do, who we all work with. So it’s not about education. It’s about truly understanding the role and the function, which starts coming into play as the company grows and becomes more complex in what they’re doing.

Chad Harvey (09:34): So that leads me into a kind of a sub-question that I get quite often when people are talking, it doesn’t matter if it’s about entry level accounting or about the higher level CFO positions, which is the qualifications. They want to know what do I actually need to be looking for here when I’m looking to slot these roles? And I know it’s going to be different for each of these different types of functionalities here, but any insight you can share into that realm.

Nelson Tepfer (09:59): So we’ve been asked many of our clients to help them with qualifying different candidates around different things. So, so much so that we’ve obviously developed what we start looking for when we get asked a lot of these kind of questions. So one of the really important ones is making sure that whoever it is you’re bringing into this role, they’ve had the impact you’re looking for before at a previous role. So if you’re looking for somebody who’s going to make sure every single thing is entered is extremely detail-oriented, that every single thing is entered correctly and on time, have they done that before? And yes, there’s an aspect to training new hires around doing certain things. And for some organizations, we get it. We understand and why they may choose to make that decision.

But it’s more important as you start moving up into more of that experience and, frankly, higher cost or higher salary for many organizations, have they had the impact you’re looking for? Have they had that impact on a previous organization? The one you’re looking for, for your company, have they had that impact before elsewhere? I don’t care what title they’ve held elsewhere. Have they had the impact you’re looking for elsewhere?

Chad Harvey (11:01): In small to medium sized business land, which I typically think of as the five million to $250 million range, that’s just my rule of thumb, I come across this so often is, and especially in the accounting realm, we’ve got somebody. They’re a good bookkeeper or they’re a good staff accountant, and we want to elevate them. And we want them to go up to the next level to do some of what you’re talking about. And I can’t tell you that it’s always a failure, but quite frankly, it’s often a failure from what I’ve seen because they don’t have that prior experience that you’re talking about.

Nelson Tepfer (11:34): So we’ve seen that grow correctly. But when we’ve been involved in those, it’s about what other resources does that person need to be successful in this new role? Do they understand what’s expected of them in this new role? Do you understand what you’re expecting of them in this new role? There’s a lot of questions we want to make sure that gets understood. We have seen some people grow very successfully within an organization from bookkeeper to a next level, next level. [inaudible 00:11:57] need to take on eventually a CFO role. It’s if they have the right context around what’s expected of them. Do they have the capacity to grow to do that? Do they have the resources that could grow to do this? Everyone gets to that next level at some point in some organization, whether it’s within yours or a different one. So it’s not like always a must have. If you’re going outside an organization, we always prefer you look for them to have had that impact before. But that doesn’t mean you cannot grow yourself. It’s just a different track when you’re looking to grow that talent internally.

Chad Harvey (12:26): Let me throw you a curve ball question we didn’t talk about before, but just occurs to me. I love putting you on the spot Nelson. You’re always good at dancing. What I’m observing, and again, I don’t come from an accounting background, so I see this stuff at a distance. But what I’ve been observing, especially over the last five years is increasing sophistication with accounting software and with ERP softwares and access to data and reporting and analytics that might previously not have been available even five, six years ago. And I’m wondering, what do you see with the folks at all the different levels in terms of how they’re using that information? I guess at the bottom of or at the end of the day, at the bottom of my list here, I want to know, are they able to use it? Do they know what they’re looking for? Or is this again coming right back to have they achieved success somewhere else before?

Nelson Tepfer (13:15): So it’s funny you mentioned that ERP and software conversation. As I jokingly refer to it, I personally have had the privilege of working across an early two dozen ERP platforms. And they’re all terrible and they’re all wonderful. So when it comes to that conversation, what’s really important to understand is with any software package you’re choosing to use or implementing what you already have in place, what should you be getting out of that software package? And yes, does everybody in your organization understand what they should be doing with this software package? It is very difficult. It is not a simple thing. Let me to rephrase that. It’s not a complicated thing, but doesn’t make it an easy thing, making sure that everyone truly understands and knows what they’re supposed to be doing.

Implementations are a big project. They definitely need to be managed correctly. But it’s understanding what you’re supposed to have out of it at the end of it is really, really key if you’re going through that. And we’ve been through custom software builds, for instance. We’ve been through upgrading from the QuickBooks into the next level ones. We’ve been upgrading from the next level ones into the enterprise level packages. It’s all about understanding what you’re supposed to be getting out of it, why you’re choosing to make this decision and do the people on your team truly understand how to do what you need them to. So mentioned before about just having more and more information. More data is great. We’re living in an environment right now where you have more data at your fingertips than ever before. That doesn’t make it something you can use just because you have more data. So it’s truly understanding how you turn all of this data into the insight you need to make the decisions to continue to grow your company and achieve your goals.

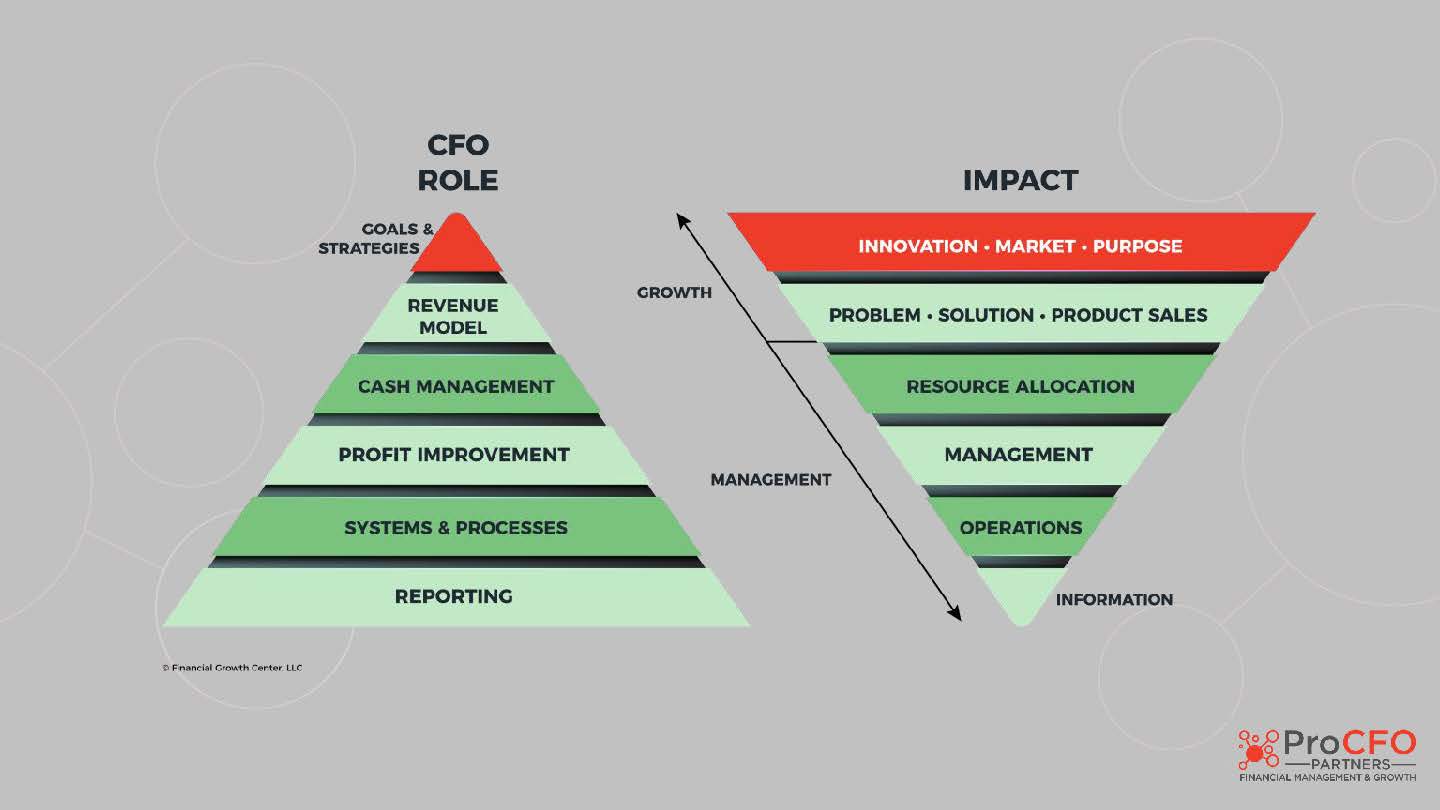

Chad Harvey (14:49): I think I want to have you back for a subsequent conversation just on the software and the data topic because I got questions coming up for me right now about, are you seeing AI applications in the finance realm? All kinds of stuff. But we’re going to put a pit in that. I want to go right to the second pyramid that you’ve got, which is about the CFO role. And maybe we spend our time talking just a little bit about that. Kind of walk us through, and I’m going to flash this up for our audience here so they can take a look at what’s going on here, but kind of walk us through that CFO pyramid, inverted pyramid graphic that you guys have.

Nelson Tepfer (15:24): Absolutely. So when we get asked a lot, what does the CFO do? I remember I used to jokingly refer to it in my very first CFO role was my job to make sure as much money as possible comes in and as little as possible goes out. What’s important to recognize is that’s a little bit of an antiquated version of it. I remember joking with somebody, a CFO veteran who’s been a CFO for 20 or two to three decades. And he said, no, we used to just call them good CFOs and bad CFOs. When you look at a company doing it, looking at a CFO like that. So it’s important to recognize from the role of the CFO is that the true impact and the true value begins to happen more at the strategic level than strictly what they’re doing day-to-day.

But when I say that, it becomes are they the catalyst and the strategist driving the growth of the business? Are they building that framework for financial management and growth? Do they need to roll up their sleeves and get involved in different areas of many companies along the way? Absolutely. And they should get involved. This is not the type of thing you do just by delegation. But from that perspective, once you move up to that level, it becomes far more about the strategic element than it is strictly about, do they know how to make this journal entry?

Chad Harvey (16:26): Mm-hmm (affirmative). Fantastic.

Nelson Tepfer (16:29): So when we talk about the different elements over there, it becomes, okay. Do we understand as an organization and does the CFO truly understanding guiding this organization, what we’re really working towards as a company? Because then anything else we talk about on the finance and accounting function, whether it’s our profitability, our cash position, the systems and processes we want to build out, all of that needs to be in support of the goals of the organization. And that’s where it becomes just the stuff that we’ve done up until now to, okay, is this actually driving the growth and the goals we’re looking for?

Chad Harvey (17:00): Mm-hmm (affirmative). So I’m an organization I’m thinking that I “need a CFO” and I’m going to come to you. What’s the question that you always get asked when someone shows up at your door step hat in hand and wants to talk about either fractional CFO or full-time CFO services?

Nelson Tepfer (17:20): Oh boy. The one question or the one problem they really have? The one question they ask or the problem they really have?

Chad Harvey (17:27): I’d like to hear both.

Nelson Tepfer (17:30): So the one problem they really have very often goes back to where we started the conversation, the lack of understanding truly about what this whole function is supposed to be doing for them. We look at our role in that CFO as making sure this entire function gets built correctly to support that is what we look at the role of the CFO. Truly building that framework correctly. But what we get asked really varies very, very, very widely because it comes from what their own problem is, why they’re having the conversation with us to begin with.

As in, I remember one CEO tells me, “Nelson, this company is too big for me to run on gut instinct alone,” which is an incredible quote. What made that so much more interesting was this is somebody who has a controller and nine people in his accounting department. And that’s still the way he feels. And it’s because he has a very operational function from the finance and accounting area. Things get done. Yes, they close their books. I mean, he wants it a little more timely, fine, but they close their books. But at the strategic level, when it comes to the initiatives he’s thinking about and how he’s analyzing it, he does not have the insight he needs to and that’s why he feels like he’s running it on gut instinct alone.

That sentiment is probably very prevalent across the board as the underlying problem we get brought in on. And while the question that we get asked may take different forms, essentially it’s very often that same sentiment underneath it. We need help with our budgeting. And it’s like, okay, great. Why? Why whatever have you done up until now hasn’t worked on the budgeting and what’s actually going on behind this? Shrinking profitability. Okay. Stagnant revenue. Again, these are all common issues that we get asked the questions about. But it comes from the same piece underneath it of your revenue may be stagnant because have you looked at how you’re growing your revenue? Have you looked at what you’re tracking and why you’re tracking this information? Have you identified those activities that are really going to a growth of your company moving forward?

Chad Harvey (19:11): Yeah. It’s so interesting to me to hear you talk about that because as I work with different businesses and in different stages of life and maturation, it’s so interesting to see them make that shift to strategic finance and couple the finance and the strategy with their overall strategic plan and endeavors. And it often presents itself prior to that switch over in a very similar way that you’re talking about, very operationally focused. And then it’s kind of like the curtains fall and they get it all of a sudden. It’s an exciting thing to see.

Nelson Tepfer (19:47): Absolutely.

Chad Harvey (19:49): All right. Nelson Tepfer, co-founder and managing partner of ProCFO Partners. It has been a pleasure as always. I enjoy our time together. And any other parting words of wisdom for the audience here?

Nelson Tepfer (20:03): Feel free to check out our website. We have a lot of free information and resources there procfopartners.com. And feel free to reach out if you have any questions.

Chad Harvey (20:11): Will do. And there’s a link to his website in the article as well as on a crawler at the bottom of the screen for everybody. So I encourage you to definitely make that call or I don’t know, do we even call anymore? We just kind of email or text or DM or hit me on Twitter, whatever it is. So, all right, Nelson, you have a great day. Thank you very much.

Nelson Tepfer (20:29): Thank you, Chad. Great talking to you.